Why Readers Trust Our Platform

We deliver comprehensive, unbiased information to help you make informed decisions about your home comfort, decor choices, and outdoor living spaces. Our content is researched, tested, and written by enthusiasts who understand what matters most.

- In-depth guides on adjustable bed technology and sleep solutions

- Seasonal decor trends and timeless design inspiration

- Equipment comparisons and maintenance tips

- Garden planning ideas for every space and skill level

What Our Community Says

Real feedback from readers who transformed their spaces

The detailed breakdowns on air mattress features helped me understand exactly what to look for. The sleep quality guides are incredibly thorough and easy to follow. I've bookmarked dozens of articles for future reference.

I never realized how much thought goes into creating a functional outdoor space until I found this site. The garden layout articles and seasonal planting guides have completely changed how I approach my backyard.

As someone who loves redecorating, I appreciate the honest reviews and style comparisons. The equipment maintenance articles have saved me so much time and hassle. This has become my go-to resource for all things home-related.

Latest articles

Our recent publications

Brighten your uk basement transformation: innovative techniques to maximize natural light

Enhancing natural light in basements is central to any successful basement renovation UK project. A primary strategy inv...

Revamp your uk terrace: pro tips for creating perfect indoor-outdoor living areas

Creating a seamless indoor-outdoor transition in your UK terrace design is vital for maximizing the utility and enjoymen...

Transform your space: top interior decoration shops near you

Elevate your living environment by exploring the best interior decoration shops near you. Find carefully curated furnitu...

Transform your uk bedroom into a serene zen retreat: key elements for unmatched relaxation

Creating a zen bedroom is about more than just decoration; it's about crafting a sanctuary that provides psychological a...

Discover the best nami figures for every collector

Nami figures capture the spirit of "One Piece" with styles ranging from playful Funko Pops to intricate, limited-edition...

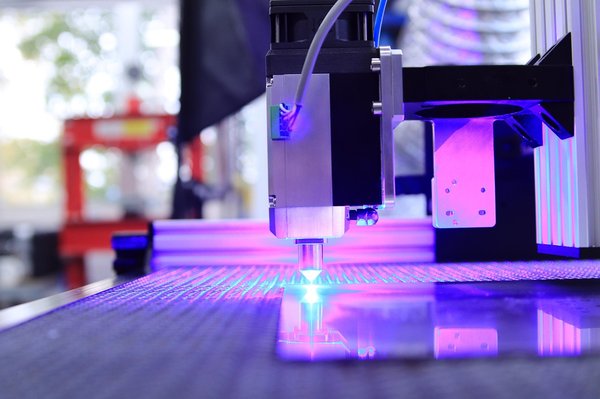

Explore the versatile world of laser engraving services

Laser engraving transforms everyday objects into personalised works of art with precision and speed. From handheld devic...

Mastering waste recycling: advanced management techniques for uk apartment complexes

Effectively managing apartment complex recycling demands tailored waste recycling techniques suited to communal living d...

Revamp your uk lounge: top designer tips for creating a chic and multifunctional haven

Modernising a UK lounge involves more than just fresh decor; it requires well-thought-out upgrades that balance style an...

Unlock optimal warmth: expert advice for perfect central heating in british homes

Ensuring central heating efficiency in British homes requires balancing warmth with energy use. UK properties often face...

Brighten up your home: the essential handbook for crafting a vibrant indoor succulent haven during joyful uk winters

Succulents offer a striking way to enhance indoor winter decor while boosting mood during the long, dark UK winters. The...

Design your dream garden: discover ourplatform's services

Discover how OurPlatform streamlines financial management with a fully paperless, user-friendly system tailored for inve...

Designing a uk sanctuary: top tips for a cat and dog-friendly garden haven

Creating a truly pet-friendly garden design in the UK begins with understanding the specific needs and behaviours of you...

Essential pest control solutions to protect your garden

Protecting your garden from pests requires targeted, effective strategies that balance plant health and safety. Combinin...

Mastering sustainable pest management: defeating greenflies in uk greenhouses

Sustainable pest management within UK greenhouses hinges on integrated pest management (IPM) principles tailored specifi...

Transform your garden vision: explore our platform's offerings

Reimagine your outdoor space with tools designed to bring your garden vision to life. Our platform offers intuitive plan...

Sustainable financing: transform your post-war suburban home in the uk with eco retrofits

Understanding sustainable home financing is crucial for homeowners aiming to improve the energy efficiency and value of ...

Transform your uk home: blending edwardian grace with modern comforts seamlessly

Combining the classic elegance of Edwardian design with contemporary elements offers a unique aesthetic that transforms ...

Transforming your uk basement flat: creative tips for enhancing charm in low-light spaces

Creating a bright and inviting atmosphere in basement flats can be challenging. However, by adopting targeted basement f...

Essential strategies for seamlessly moving into a heritage listed home in the uk

Understanding heritage preservation regulations is crucial when moving into a listed property. These rules protect the h...

The definitive guide to notifying your neighbors about moving in the uk: a creative approach

Community life thrives on notifying neighbors about relevant changes or events, fostering an environment of mutual suppo...

Ultimate guide to effortless moving with big pets: expert tips for a smooth home transition

Moving with large pets can be a daunting task, but careful planning and preparation can ensure a smooth transition for b...

Decoding uk state pension changes for eu expats: key insights and recent updates

Since Brexit, UK state pension changes have significantly altered the landscape for EU expats. The most notable legislat...

Discover the uk's innovative strategies to combat ocean plastic pollution

The UK government has implemented several significant policies targeting ocean plastic pollution, reflecting a strong co...

Navigating uk healthcare complaints: a step-by-step guide to effectively resolving service issues

When encountering problems with healthcare services in the UK, prompt and clear action is essential. Begin by documentin...

Choosing green: the ultimate guide to sustainable building materials for eco-conscious home renovations in newcastle

Sustainable building materials play a critical role in fostering eco-friendly construction practices. These materials ar...

Exploring bristol's home loan landscape: an in-depth beginner's guide to fixed and adjustable rate mortgages

The Bristol home loan market is a dynamic and evolving landscape, offering a variety of mortgage options for aspiring ho...

Insider advice: how to choose the ideal real estate agent for selling your luxury surrey home

The world of luxury real estate is not only about opulent properties but also about the calibre of agents who navigate t...

Elevate your modern uk home with exquisite pool designs for a chic makeover

Discovering modern pool design ideas can dramatically elevate your home's appeal. Many contemporary UK pools feature cle...

Elevate your uk living space: innovative ideas for crafting a beautiful and practical poolside oasis

Designing poolside areas in the UK means blending aesthetic appeal with smart adaptations for unpredictable weather. Whe...

Mastering indoor humidity for uk swimming pools: your essential guide to ideal conditions

Maintaining optimal indoor humidity management is crucial for ensuring swimming pool comfort and safety. High humidity l...

Ready to Elevate Your Living Space?

Dive into our extensive collection of articles, guides, and insights. Whether you're seeking better sleep, stunning decor, reliable equipment, or a thriving garden, we have the information you need to make it happen.

Discover →